Take time to apply, save money

Scholarships, financial aid can help with college pricetag

February 14, 2020

As seniors decide where they will attend school next year and juniors begin the college search, costly tuition, fees and housing often stand in the way of students’ abilities to attend expensive schools. Even with taking financial aid and student loans into consideration, price can be the make-or-break factor in deciding which college to attend.

“Having a conversation with family about expectations around the cost of college is an important first step,” college counselor Rebecca Munda said. “This is something we talk about with families because college is a huge investment.”

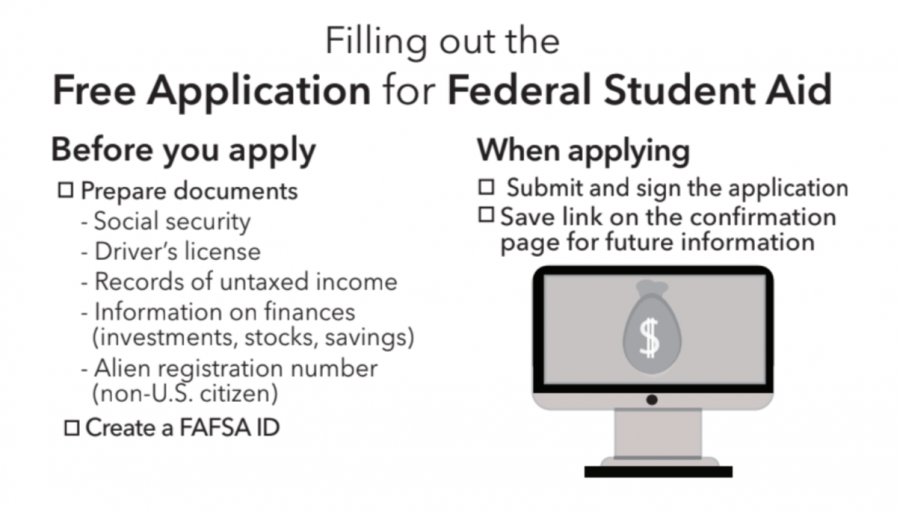

The Free Application for Federal Student Aid, an online federal application prospective college students and their parents or legal guardians fill out to qualify for need-based financial aid, provides more than $120 billion of aid each year, according to StudentAid.gov.

“Although the FAFSA is a federal aid application, state schools and some private universities use it to distribute aid,” according to StudentAid.gov. “A scholarship might cover the entire cost of your tuition, or it might be a one-time award of a few hundred dollars. Either way, they’re worth applying for, because it’ll help reduce the cost of your education.”

The FAFSA allows the Department of Education to determine a student’s potential financial aid eligibility by reviewing their Expected Family Contribution, according to PrepScholar. EFCs are determined by family income, tuition of other siblings, medical expenses, rent or mortgage fees and other living expenses.

“The FAFSA application process was fairly straightforward, although it was a bit tedious,” senior Zoe Hinks said. “I particularly did not appreciate the fact that you can only list up to 10 schools on the FAFSA. If you’re applying to more, you have to file it again.”

President Trump signed the Fostering Undergraduate Talent by Unlocking Resources for Education Act in December 2019 to eliminate 22 questions from the FAFSA — which has 108 questions — by attaching copies of a parent or guardian’s tax returns to the application to make it easier for applicants to complete.

The College Board also has its own financial aid application system, the College Scholarship Service Profile, which is used by many private schools to consider a prospective student’s desired amount of financial aid.

The Broadview reached out to multiple members of the Class of 2020, but those who filled out the CSS Profile declined on-the-record interviews, citing finances as a personal matter.

The CSS Profile determines how much non-federal financial aid a student may qualify to receive from nearly 400 schools. It assists universities in awarding over $9 billion in grants.

Although the FAFSA is more commonly used, the CSS Profile paints a more complete picture of a student’s financial background and even allows for applicants to explain financial circumstances specific to their family, according to The College Board.

“It’s definitely worth it to apply to expensive schools if you really want to go there because lots of schools give financial aid as well as merit scholarships through these programs to make potentially attending the school more possible,” Hinks said.

With the vast number of scholarships available for students, whether applied or offered, there is a level of unpredictability when applying, according to Munda. To compensate for this unpredictability, every college’s website has a net price calculator for families to input their financial information in order to see the probability of receiving scholarships and aid from that school.

In addition to federal financial aid options, students can qualify for private scholarships offered by colleges based on merit or apply to an organization based on a variety of criteria.

“Students may receive scholarships that come from the institution and typically the students don’t have to submit an additional application,” Munda said. “These can be merit based scholarships and can be very helpful for students making their decision.”

Merit scholarships differ from financial aid in that they don’t take into account the income of a student’s family. Students can apply for more than one merit scholarship which can culminate in order to significantly decrease tuition cost.

“Applying for scholarships can be very overwhelming because there are so many different sites and applications to choose from,” Grace Ainslie ’18, who receives financial aid, said. “Entering into the process without the advice of others is scary as there is just so much to choose from.”

Many private scholarships look not only at GPA or grades, but also at the character and integrity of the student — significantly influencing a college’s decision to give money.

“For some schools, you get automatic consideration for scholarships just by applying or doing early decision and for others you have to write essays or do interviews,” Claire Kosewic ’18, who earned a merit-based scholarship, said. “I looked at a lot of different schools with scholarships because I knew that would make going to college just a lot easier.”

Schools also grant merit scholarships or financial aid as a way to persuade a prospective student to attend its university. On average, students receive about $10,000 in scholarship money from four-year institutions, according to the National Center for Education Statistics.

“You should focus in the classroom in addition to being an earnest, kind student,” College Counseling Director Cesear Guerreo said. “Colleges will say ‘We need to give her some money, because we like her as a person, we like her grades and we like her test scores.’ This is the kind of student leader that free money is out there for.”

It is unlikely that a college with a low acceptance rate will seek out students to offer private scholarships, because often there is no need to attract applications through financial aid, according to Munda.

“The more schools that students apply to that fall in their ‘likely’ category, the more likely they are to receive merit scholarships,” Munda said. “Highly selective institutions typically do not offer merit scholarships and offer need-based aid depending on the family’s financial income.”

Access to scholarships not only provides financial relief, especially for those who do not qualify for financial aid, but allows for exposure to other schools and institutions that may be more willing to offer financial relief opportunities, according to Munda.

“It’s going to be different for every student as to whether or not scholarships are a criteria for them as well,” Munda said. “But it may also help them consider other schools that may not have been so strong in their radar when they’re being offered significant merit scholarships.”

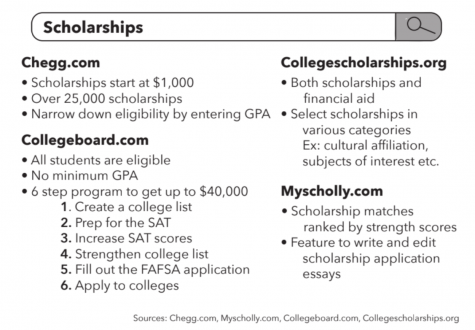

Scholarships not affiliated with universities can be found on various websites like Myscholly.com.

Students who have questions or are unsure where to find resources for scholarships or financial aid can meet with the college counseling staff on either the Pine/Octavia Campus or Broadway Campus.

“Come talk to the college counseling team,” Munda said. “We also have resources for scholarships that are not affiliated with colleges such as different scholarship guidebooks and online databases. Students typically receive the most significant scholarships directly from the institution, but there are private scholarships that are not affiliated with colleges.”

— Charlotte Ehrlich contributed to this story.