Mobile payments provide convenience

Digital payment services are transforming traditional commerce

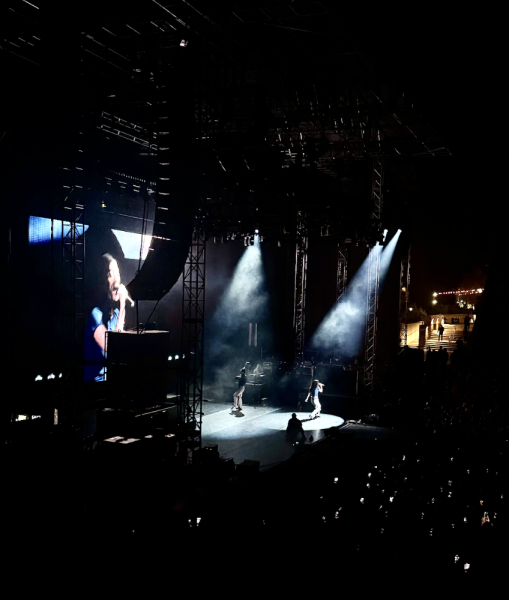

Senior Anna Doggett pays for her lunch at Mayflower Market using Apple Pay, like she does most days. Instead of cash, Doggett uses mobile payment methods more often than she uses cash or a debit card when purchasing her meals or buying products.

November 1, 2018

When she pays for her frequent lunches at Mayflower Market, senior Anna Doggett avoids fumbling through her wallet to count out exact change by hovering her phone over the card reader using Apple Pay.

Doggett is a part of the growing digital payment movement driven by the services which aim to make paying and getting paid a faster and easier process. The shift towards mobile payment methods is growing so rapidly that Capgemini and BNP Paribas predict digital transactions will reach a record 726 billion by 2020.

“I use my phone to pay whenever I can at a store,” Doggett said. “I am a very forgetful person and never remember to bring my card with me, so mobile payment is a huge lifesaver.”

Platforms like PayPal, Google Pay and Venmo have gained popularity as an increasing number of individuals recognize the benefits of mobile payments, including greater security and fewer fees, according to Forbes.

“PayPal has been really focused on democratizing financial services, which basically means giving people access to their finances quickly and access to manage their money without a lot of fees,” Amanda Coffee, ’04, a lead manager at PayPal’s Corporate Communications, said. “There are some people in America who spend 9 percent of their finances on transaction fees, which is just way too high.”

While e-commerce only makes up one-tenth of all commerce, mobile and online payment services have moved people away from the manual process of accessing money through a bank or ATM, according to Coffee.

“The traditional financial industry is a very important part of the overall ecosystem, but it all too often takes a one-size-fits-all approach to a very complicated and diverse landscape,” Coffee said. “With technology, however, all people in the world are able to take control of their finances.”

Doggett says she prefers using mobile payment because it is a convenient and secure payment method.

“I feel more comfortable using my fingerprint or password on my phone to complete a transaction over carrying a debit card that I could lose,” Doggett says. “I think all people should at least have a mobile payment method as an option because you never know when you might need it.”

Other students such as junior Mira White are opting to only pay in established ways with a cash or a debit card.

“Some people use things like Apple Pay because it means not carrying a wallet, but my iPhone case has a cardholder so my debit card is always with me,” White said. “I just don’t really have a major need to use mobile payments.”

White says she does not plan to sign up for any available digital services soon, but adds her decision to not use mobile payment methods sometimes becomes an inconvenience for others who do use them. Not having Venmo — an app that allows users to see other’s transactions of sending or requesting money to friends in a social-media feed — is difficult because most of her friends have accounts.

“There have been a few times where my friends have asked, ‘Can I Venmo you instead of giving you cash?’” White said. “Since I don’t have Venmo, they get frustrated and it ends up taking them a lot longer to pay me back.”

Despite consumers like White, nearly $885 million worth of U.S. transactions will be mobile by the end of 2018, according to Statista.

“Technology is transforming every aspect of our lives at a pace and scale that is without precedent in human history,” Coffee said. “It’s also enabling commerce to enter new contexts and unlocking opportunities for merchants and consumers to connect at the point of discovery and commerce.”